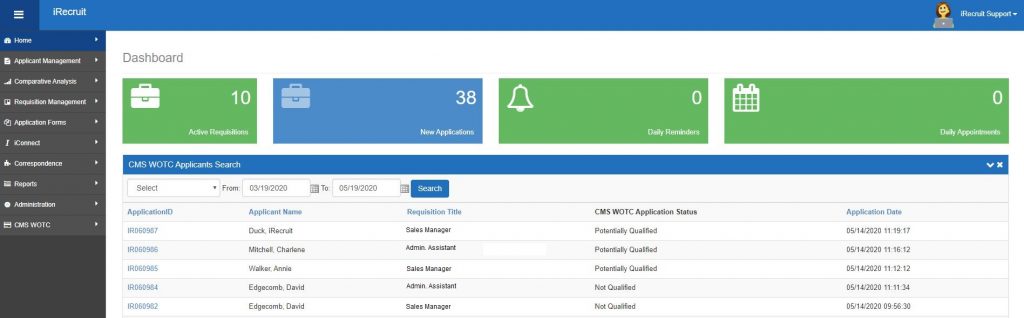

iRecruit is pleased to announce that we have added increased Work Opportunity Tax Credit integration into iRecruit. The integration is immediately available for customers who use both iRecruit and CMS’s Work Opportunity Tax Credit Administration services.

The new streamlined integration allows customers to increase their WOTC particiption, quickly identify potentially qualified candidates through reporting and dashboard widgets, as well as the applicant profile page. The integration also allows for reporting of new hires, which speeds up the reporting process to state workforce agenices.

While iRecruit has always been able to support the Work Opportunity Tax Credit, we are especially excited to be able to streamline the process for our customers. The integration will make sure less people “fall through the cracks,” increase participation, and increase the number of potentially qualified candidates for our customers.

About the Work Opportunity Tax Credit

WOTC or Work Opportunity Tax Credit is a Federal tax credit available to employers to hire and retain individuals from target groups with significant barriers to employment. Between 8-15% of New Hires may fall into one of 10 qualifying categories for WOTC. This can make you eligible to receive a tax credit of between $2,400 and $9,600 depending on the qualifying category. CMS has been providing WOTC screening since 1997.

About iRecruit

![]() iRecruit is a cloud-based recruiting and applicant tracking and electronic onboarding software designed to provide any size of business a cost effective, affordable and truly simple way to manage the recruiting and onboarding process online. With options for Express, Professional and Enterprise, you can find a flexible recruiting and onboarding solution that works for your budget, and meets your needs. Join us for a demo or ask a question.

iRecruit is a cloud-based recruiting and applicant tracking and electronic onboarding software designed to provide any size of business a cost effective, affordable and truly simple way to manage the recruiting and onboarding process online. With options for Express, Professional and Enterprise, you can find a flexible recruiting and onboarding solution that works for your budget, and meets your needs. Join us for a demo or ask a question.