iConnect is iRecruit’s paperless, electronic onboarding module that adds on to iRecruit. You can use iConnect to collect new hire information, including forms such as I-9s, W-4s, Direct Deposit, Emergency Contacts and more.

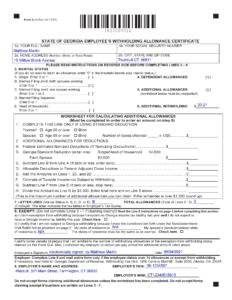

If you have employees throughout different states, it’s important to include the correct W-4 forms when you hire.

There are currently seven states which use the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.

- Colorado

- Delaware

- Nebraska

- New Mexico

- North Dakota

- South Carolina

- Utah

iConnect allows you to utilize as many State Tax Withholding Forms as you need to. When you post a job, the appropriate State W-4 is automatically assigned based on the location where you are posting the job. If the employee needs a different state W-4, you can easily assign it to them, at the same time as removing the incorrect one.

All forms are completed securely online, and a PDF is generated once the State Tax Withholding form is saved.

About iRecruit

![]() iRecruit is a cloud-based recruiting and applicant tracking and electronic onboarding software designed to provide any size of business a cost effective, affordable and truly simple way to manage the recruiting and onboarding process online. With options for Express, Professional and Enterprise, you can find a flexible recruiting solution that meets your needs.

iRecruit is a cloud-based recruiting and applicant tracking and electronic onboarding software designed to provide any size of business a cost effective, affordable and truly simple way to manage the recruiting and onboarding process online. With options for Express, Professional and Enterprise, you can find a flexible recruiting solution that meets your needs.